Savings are the starting point of your path to keep your finances on track. It’s the first step every individual needs to form the base for his cash flows. One needs to keep in mind that saving isn’t a onetime action, but rather a habit.

how to save money, how to invest money, financial planning, how to become rich, money, savings, How much should you save, how can you save, How much should you borrow, how to take loans

Whenever you borrow by taking a loan, you need to consider the financial implications of the borrowing on your current and future finances.

We earn to fulfil the necessities of life and provide a decent standard of living for our family. However, with rising costs in every sector of life, whether it’s medical, living expenses or transportation costs, these earnings need to be put to work, to enable wiser borrowing and earn returns as well. This necessitates the need for a neatly chalked-out financial plan involving the three essentials of everyone’s financial life-savings, borrowing and investment. Let us discuss these in detail:

1. Savings – How much should you save?

Savings are the starting point of your path to keep your finances on track. It’s the first step every individual needs to form the base for his cash flows. One needs to keep in mind that saving isn’t a onetime action, but rather a habit. Firstly, contrary to the common practice of saving after spending, one should first earmark a portion of one’s monthly income for savings and then spend and invest the rest. However, savings ratio would depend on your age and responsibilities on your shoulders. When you are young and have just started earning, you can maintain a higher savings ratio by earmarking 40-50% of your income for saving and investment purposes.

It’s important to consider savings as a priority, rather than just a choice. You must save enough to build and maintain your emergency fund, which assists in tackling financial exigencies such as job loss or severe illness. This emergency fund should amount to at least 3-6 times your monthly expenses. These funds can be parked in high-yielding savings accounts, since these are offering interest rates as high as 7.25%, along with highest form of liquidity. As your age and responsibility grows, the size of your emergency fund should also grow proportionately.

For those who find it hard to resist the urge to spend impulsively, another way of saving is by setting up an automatic monthly deposit into your savings account from your salary account. Or else, you may also consider investing in recurring deposits (RD) by asking the bank to apply standing instructions, which will result in automatic deduction of the set amount per month. Moreover, one may consider their monthly targeted savings amount as a monthly bill which needs to be compulsorily paid, if that helps. At McLeod Capital Fund we show you a unique approach to saving. There is indeed a way to save tax free, free of fees and recieve a higher interest rate 4-6 times more than your regular bank.

2. Loans – How much should you borrow?

Whenever you borrow by taking a loan, you need to consider the financial implications of the borrowing on your current and future finances. Borrowing through loans involves repayment of the principal along with various fee, charges and interest rate applicable. Therefore, even if you need funds, make sure you choose the loan amount, lender, loan tenure and interest rate as per your affordability. Do not borrow more than what you can comfortably repay.

Loan eligibility and EMI calculators available on online financial marketplaces make it extremely convenient for borrowers to check whether they are eligible to take the loan and show them the EMI payout as per their loan tenure, loan amount and interest rate. Additionally, your loan to income ratio shouldn’t ideally exceed 50%, i.e., you shouldn’t be paying more than half your monthly earnings as loan EMIs.

Lenders judge your repayment capacity while evaluating your loan application. Your income, fixed obligation to income ratio (FOIR), credit score, age etc. are taken into account while judging your repayment capacity. FOIR is the proportion of your income already being paid out as debt payments, such as loan EMIs. Before borrowing, make sure your FOIR doesn’t exceed 40-50% (including new loan’s EMI), since lenders may hesitate in providing loans to borrowers breaching this mark.

When you take a loan, you spend tomorrow’s income today in the form of EMIs paid every month, including both the interest and principal repaid. Therefore, in case there isn’t any link between what you earn and what you spend, chances of falling into a debt trap increase. At McLeod Capital Fund we specalize in showing you the different loans programs available to help you borrow and create wealth.

3. Investments – Where and How much should you invest?

Apart from keeping your emergency funds in high-yielding savings account, make sure rest of your savings aren’t kept idle. Mere savings won’t suffice in the long run to take care of all your expenses. Make your money work for you by investing it to generate returns. Investments helps in achieving various financial goals pertaining to different investment horizons, with the investment avenue depending upon the investor’s risk appetite, age, time horizon and purpose of investment.

For investors looking to invest for a short to medium time period (1-3 years) to fulfill goals such as buying a car or planning for a vacation abroad, low risk investments options such as fixed deposits, recurring deposits or debt mutual funds can be availed, with returns as high as 8.75% p.a. in fixed deposits. Whereas for those looking to invest for long-term goals such as child’s higher education and marriage, or retirement planning should prefer investing in equity mutual funds and or Life Insurance. Equities have been, for long, outperformed peers for long-term returns, consistently generating inflation beating returns over the long period while Life Insurance is more guranteed and stable because there are no fees tax or market risks involved.

Moreover, most households in our country still prefer investment in physical assets such as gold and real estate properties. It’s advisable to keep majority of your investments in financial assets such as these to stand higher chances of generating higher returns, especially in the long run. McLeod Capital fund is dedicated to helping you achieve your real estate investing goals.

An Individual Retirement Account (IRA) is a form of retirement account that provides investors with certain tax benefits for retirement savings. Some common examples of IRAs used by investors include the traditional IRA, Roth IRA, Simplified Employee Pension (SEP) IRA, and Savings Incentive Match Plan for Employees (SIMPLE) IRA. All IRA accounts are held for investors by custodians or trustees. These may include banks, trust companies, or any other entity approved by the Internal Revenue Service (IRS) to act as a trustee or custodian. If you have any type of IRA at all, someone is a custodian for it.

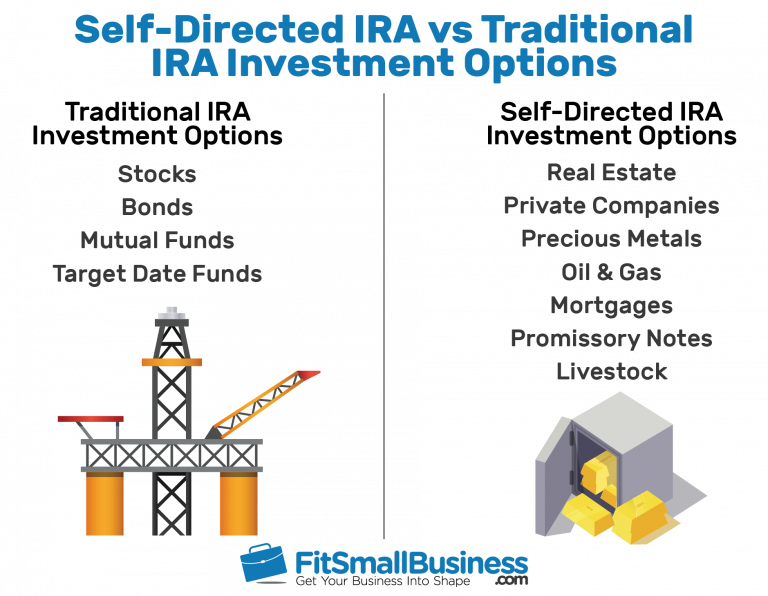

A self-directed IRA is an IRA held by a trustee or custodian that permits investment in a broader set of assets than is permitted by most IRA custodians. Most IRA custodians are banks and broker-dealers that limit the holdings in IRA accounts to firm-approved stocks, bonds, mutual funds and CDs. Custodians and trustees for self-directed IRAs, however, may allow investors to invest retirement funds in other types of assets such as real estate, promissory notes, tax lien certificates, and private placement securities. In the case of The 98 Company, you’d be using your SD/IRA for a private placement security.

You probably have an IRA, but that doesn’t mean it’s self-directed. An SD/IRA is a specific type of IRA, and if you don’t have one, you can’t use your IRA funds to buy into a private security. You must rollover your IRA into a self-directed IRA.

If you purchase partnership interest in The 98 Company using your SD/IRA, the value of your partnership share will grow tax-free until you take distributions from your IRA when you retire, which is the advantage.

There are two main ways to employ a self directed IRA:

The first way is to send instructions to your IRA custodian to send a check or wire and purchase the investments in the name of the IRA. This is how most custodians prefer because it allows them to continuously charge for activity fees etc. You would complete The 98 Company’s subscription booklet as an entity (the IRA) and not yourself.

The second way is to use an underlying LLC. You would create an IRA-owned Limited Liability Company. The LLC is “owned” by the self-directed IRA, but managed by you, and becomes the investment arm for your IRA. You open a checking account for the LLC at a bank of your choice. You tell your custodian to transfer IRA funds from the IRA to the new self-directed IRA LLC checking account. That funds the LLC and lets you use your checkbook to purchase assets on behalf of your SD/IRA.

Things to avoid:

Never mix funds from an IRA and your personal accounts. If you use some money from an SD/IRA to invest in The 98 Company, and some of your personal money, you need to complete two separate subscription booklets, and invest using an entity (the IRA) and your personal self, separately.

If you buy real estate using your SD/IRA, you cannot live in it, and you can’t put on a tool belt and work on the house yourself. You must hire a third party to do everything.

Any distributions from The 98 Company will go back to your IRA or LLC’s account. You would not have access to any of that money until you take distributions from your IRA.

If you set up an LLC for your SD/IRA, it requires a very special operating agreement. You can’t use a standard operating agreement for this type of LLC. You should get some help from an attorney on this.

Why Invest in Real Estate?

That’s a good question. Residential real estate ownership is gaining ever-increasing interest from retail investors for many of the following reasons:

Real estate provides more predictable returns than stocks and bonds. Real estate provides an inflation hedge because rental rates and investment cash flow usually rise by at least as much as the inflation rate. Real estate provides an excellent place for capital in times when you’re unsure of prospects in the stock and bond markets or when investors expect long-term returns in equities, debt instruments, and other assets to be inadequate. The equity created in a real estate investment provides an excellent base for financing other investment opportunities. Instead of borrowing to get the capital to invest (i.e., buying stocks on margin), investors can borrow against their equity to finance other projects. The relative ease in borrowing against a real estate investment, combined with the deductibility of the mortgage interest, makes this option a less-expensive method for financing other opportunities for investors who are comfortable taking on additional financial risk. In addition to providing cash flow for owners, residential real estate can also be used as a home or for some other purpose (obviously, not at the same time).

Passive vs. Active Income One key distinction between buying and holding and flipping properties is that the former can provide you with passive income, while the latter provides active income. Passive income is money that comes to you each month, wherever you are, from your investments. It could be from stocks and bonds or from owning rental property and receiving rental income each month, provided you hire a management company to do all the required tasks, such as finding tenants, collecting rent, and taking care of maintenance.

Active income is money that you earn—your salary from work is one example, flipping houses is another. Flipping is considered active income because whether or not you are doing the physical labor of putting up sheetrock and stripping floors, it is a business that you engage in—finding a property to flip, purchasing it, obtaining insurance, overseeing contractors, managing the project, and more. In this sense, flipping isn’t really an investment strategy the way investing in the stock market is. If you have a day job, keep in mind that your off-hours will likely be taken up with all of the demands that flipping a property entails.

Two Ways to Flip Properties Two major types of properties can be used in a buy/sell approach to real estate investing. The first is houses or apartments that can be purchased below current market value because they are in financial distress. The second is the fixer-upper, a property with structural, design, or condition issues that can be overcome to create value.

Investors who focus on distressed properties do so by identifying homeowners who can no longer manage or sustain their properties or by finding properties that are overleveraged and are at risk of going into default. Those who prefer fixer-uppers, on the other hand, will remodel or enhance a property so that it works better for homeowners or is more efficient for apartment tenants.

Using this tactic, the buyer of a fixer-upper is relying on the invested capital to increase values as opposed to just buying property at a low basis to create high investment returns. Of course, it is possible to combine these two strategies when flipping properties, and many people do just that. However, finding these opportunities can be difficult over a protracted, consistent period of time. For most people, flipping properties should be considered more of a tactical strategy than a long-term investment plan.

The Pros and Cons of Flipping Pros Faster return on your money Potentially safer investment Cons Costs Taxes Pro: Faster return on your money One big advantage of flipping properties is the ability to realize gains immediately and to have capital tied up for the shortest time possible. The average timeframe for flipping a house is about six months, although first-timers should expect the process to take longer.

Pro: A potentially safer investment Unlike the stock market, which can turn in the middle of a day, real estate markets are more easily predicted and can produce extended periods that compensate investors for flipping properties. In this sense, flipping properties could be considered a safer investment strategy because it is intended to keep capital at risk for a minimal amount of time and because it lacks the management and leasing risks inherent in holding real estate—not to mention the hassles of finding tenants, collecting rents, and maintaining a property.

Con: Costs Flipping houses can create costs issues that you don’t face with long-term investments. The expenses involved in flipping can demand a lot of money, leading to cash flow problems. Because transaction costs are very high on both the buy and sell side, they can significantly affect profits. Keep in mind, too, that if you are giving up your day job and relying on flipping for your income, you’re also giving up a consistent paycheck.

Con: Taxes The quick turnaround in properties (and speed is everything in successful flipping deals) can create swings in income that can boost your tax bill—especially if things move too fast to take advantage of long-term capital gains tax rules.1 What this means is that if you own a property for less than a year, you’ll have to pay a higher capital gains tax rate based on your earned income.

The Pros and Cons of Buy-and-Hold Pros Ongoing income Increase in property values Taxes Cons Vacancy costs Management and legal issues

Pro: Ongoing income Owning rental property provides you with regular income, no matter where you are or what you are doing. What’s more, buying and holding real estate is a known recipe for amassing great wealth. Most “old money” in the U.S. and abroad was accumulated through land ownership. Despite periods of decreasing prices, land values have almost always rebounded in the long run because there is a limited supply of land.

Pro: Increase in property values The longer you hold your investment property, the more likely you are to benefit from inflation, which will boost the value of the property and allow you to increase the rents you charge. Also, should you decide to sell later on, if you were able to purchase during a buyer’s market and sell during a seller’s market, there’s the potential for realizing a significant return on your investment.

Pro: Taxes Owning a rental property has tax advantages not available to flippers. Rental property is taxed as investment income, with lower tax rates, and you can write off expenses, which include repairs, maintenance/upkeep, paying a property manager, driving to/from your property, and more. You also can write off any depreciation of your asset. And, should you decide to sell after owning the property for more than a year, you’ll pay taxes at the long-term capital gains rate.

Con: Vacancy costs One of the risks a rental property owner takes on is finding tenants, whether you do it yourself or hire a management company to do it for you. If your property sits empty for months or years at a time, you are responsible for covering the mortgage during that period. Before investing in a buy-and-hold property, you’ll want to make sure your budget will cover one to three months of vacancy per year—or put off buying until you do.

Con: Management and legal issues Long-term real estate ownership is a management-intensive endeavor that is outside the skill set of many investors. Many investors, especially first-time rental property owners, are ill-prepared or ill-equipped to deal with the responsibilities and legal issues that come with being a landlord. The process of finding quality tenants and servicing their needs, along with handling the maintenance and upkeep of the property, can be a stressful and time-intensive undertaking, but successful property management is necessary for ensuring ongoing cash flows from one’s investment.

Choosing a Strategy To decide whether flipping properties or holding them long-term is the most appropriate strategy, you need to answer a few critical questions for yourself. You must decide whether the capital allocation is a permanent or a transient one and whether it is a core part of an overall investment strategy or a means to enhance returns. You also need to determine what risk and return ratio is appropriate for this portion of your investment portfolios and whether you have the appropriate tolerance and skills to take on the management responsibilities that go along with either type of investment.

If the capital is not available to purchase a diversified portfolio, a prospective investor must be prepared to take on unsystematic risk, including individual property risks and potential lack of demand for the property, whether by homeowners or renters. If you’re considering a buy-and-sell strategy, you must also determine whether you have the skill to uncover distressed sale properties or fixer-uppers. In this transactional strategy, it’s important to determine whether capital can be turned enough times within a given investment period to overcome the transaction costs on both the buy and sell sides, including brokerage, financing, and closing fees.

You can enjoy the benefits of both strategies by developing a business flipping houses and using your profits to invest in buy-and-hold properties that provide long-term rental income. The Bottom Line Although the choice between the two strategies in question depends on your particular financial situation and goals, the long-term holding strategy is generally more appropriate for those who use real estate as a core portion of their overall investment portfolios; flipping properties is more appropriate when real estate is used as an adjunct or a return-enhancement tactic.

Investors wishing to amass wealth and to derive income from their real estate investments should consider holding real estate for the long term, using the equity built into the portfolio to finance other investment opportunities, with the potential of eventually selling the properties in an upmarket. Flipping properties is a tactic that is best suited for periods when prospects in the stock and bond markets are low, or for people wishing to realize short-term capital gains for as long as the present market will allow.

Investing Definition Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit. more Real Estate Investment Trust (REIT) Definition A real estate investment trust (REIT) is a publicly traded company that owns, operates or finances income-producing properties. Learn more about REITs. more Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. more Real Estate Investment Group A real estate investment group is an organization that builds or buys a group of properties and then sells them to investors. more Passive Income Passive income is earnings derived from a rental property, limited partnership, or other enterprise in which a person is not actively involved. more Investment Real Estate Investment real estate is property owned to generate income or is otherwise used for investment purposes instead of as a primary residence. more